Pact™ has removed app development and maintenance costs for you, to make sure you stand out, delivering our white label services to travel, motor and home insurance

Guest Mobile

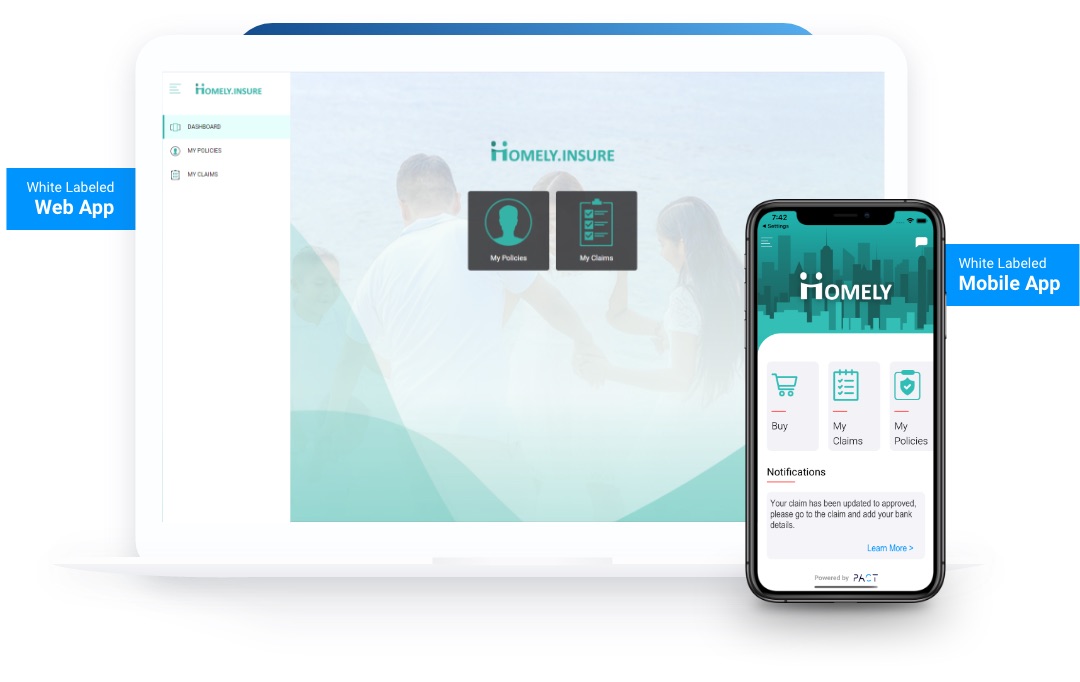

White Labelled Apps

Many in insurance want to offer their customers mobile or web applications, whether that be for buying, renewing or making a claim. However, the biggest barriers to businesses developing mobile applications are inexperience, time and cost. A single platform app can take at least 6 months to develop, two platforms increasing that time to over 9 months according to Venture Beat (2017). Development costs are even more frightening at over £110,000, compounded by at least £45,000 a year in maintenance costs. Whether a small insurance broker or an insurance leader, where costs could be 10-fold, Pact™ is removing these barriers and serving the industry in the way it deserves.

Overall Features

Fully Branded To You

Electronic Notification of loss (ENOL) making and tracking claims

ENOL buying and policy renewal

Policy and Schedule: Download with access to personal details meeting GDPR requirements.

Provides both manual and automated claim journeys for your customers

GPS enables us to pinpoint exactly where your customer is when making the claim and where the incident occurred

Your customer can upload videos and pictures along the claims journey from Google Drive, Dropbox, iCloud, OneDrive, their device or take them on the spot

API enabled

All along the journey we give your customers prompts and guidance giving them a helping hand along the journey

24/7 Chatbot, delivering real time notifications on claim progression and helping with policyholder questions.

Find the most important numbers needed quickly, from insurer, claims handler, and more

Multi-layered personal identity verifications

Digital signatures

Biometrics with fingerprint, voice, and facial recognition

Meets GDPR requirements

Availability on the Web, Android, and iOS

Some Bespoke Features Include

Travel

- Easy access to 24 hr Medical Assistance Claims

- Global Emergency Service numbers from Embassies to Police for travel.

- Emergency medical assistance direct dial button – Medical assistance to intervene as early as possible to control medical costs

Home

- Vault Inventory Management for property – Provides the unique ability to identify policyholders’ personal effects creating a product profile for inventory management. It streamlines the identification of damaged or lost goods.

- Identifies policy cover and limits for valuable items and eliminates any potential conflict during the claims process.

Motor

- Dashcam for motor.

- Telemetric capabilities to make more informed decisions on your drivers, their driving patterns and more

FAQ

Are the mobile applications and web portal built to meet GDPR?

All Pacts mobile applications and web portals are built to meet GDPR standards, using the most up to date technology delivering the most up to date security.

Can the mobile applications and web portal be integrated in to any Claims Management System (CMS)?

Yes, we have integrations going on in to Guidewire, Salesforce and Duckcreek, as well as our own CMS.

Do I have to use Pact mobile application and web portal?

No, our technology is built is a modulised fashion, meaning you can use your own front end, if you have one. This is just an added bonus for our partners.

Is a user restricted to the mobile app if they start the claim there?

No, Pacts mobile, web and telephone claims channels are all linked to a single database allowing users to start, save as draft, continue or submit their claim across all channels. For example starting a claim on your mobile phone, then adding final documents from web portal before submitting it.

What’s the difference between the mobile applications and web portal?

The mobile applications can only be downloaded from the Apple Appstore and Google Play Store, whereas the web portal is added to the website of our partners.